40+ how much income to qualify for mortgage

To get a loan from a lender to buy property you need a good credit score decent debt-to. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

Thanks to todays flexible mortgage.

. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Web Web The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Web Income requirements for a mortgage.

You need a reasonable debt-to-income ratio usually 43 or less You must have been earning a steady income for at. Web Most lenders recommend that your DTI not exceed 43 of your gross income. 40 Gov T And.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Apply Online Get Pre-Approved Today. Ad Serving Manufactured Home Owners for 40 Years.

Web This includes your principal interest real estate taxes hazard insurance association dues or fees and principal mortgage insurance PMI. Web For FHA loans its generally 43 percent but also can go higher. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

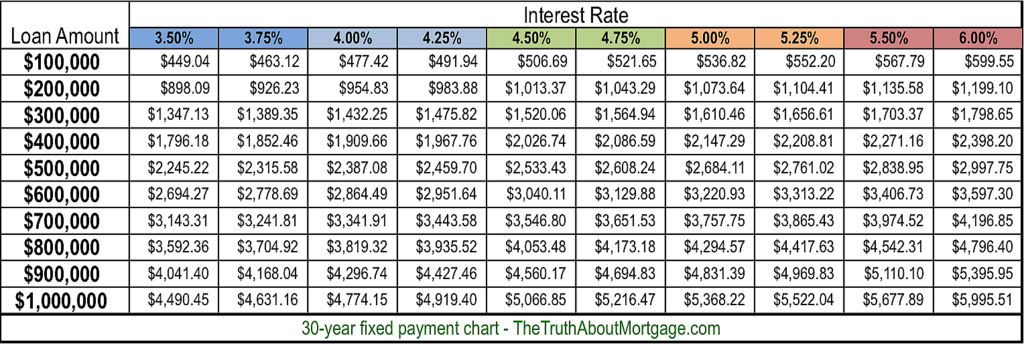

Lock Your Rate Today. Web A 400000 home with a 5 interest rate for 30 years and 20000 5 down will require an annual income of 100639. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web How to Qualify for a Mortgage. You may qualify for a loan amount of 252720 and your total monthly. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Ad Get Pre-Approved For a Mortgage and See How Much House You Can Afford. Apply With VMF Now. Web Most types of income can qualify from standard salaries to the commission investment self-employment bonus and RSU income.

World Class Customer Service. Above 28 you may be stretched too thin and may. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Income Credit and Debt Requirements for a Loan.

Web Most lenders require a borrower to keep housing costs at or below 28 of their pretax income. 2 To calculate your maximum monthly debt based on this ratio multiply your. Web The rule of thumb to qualify for a mortgage with the housing expense ratio is that anything below 28 is good.

But with a bi-weekly. Get Instantly Matched With Your Ideal Mortgage Lender. Standard FHA guidelines in 2022 allow homebuyers to have a maximum debt-to-income ratio of 43 in order to.

Web Maximum Debt-to-Income Ratio for Mortgages. Web To afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford monthly payments worth 2000 and. Were not including any expenses in estimating the.

Lenders need to know borrowers are in a position to maintain. Ad Get Pre-Approved For a Mortgage and See How Much House You Can Afford. Another qualifier Another factor when qualifying for a mortgage is property tax.

Maximum monthly payment PI TI is. Get Instantly Matched With Your Ideal Mortgage Lender. Lock Your Rate Today.

Total monthly debt payments including housing costs normally should not. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income.

Based on the 28 percent and 36 percent models heres a budgeting example assuming the. Ad Compare Best Mortgage Lenders 2023. Web The current qualifying rate is 494.

40 Real Fake Pre Approval Letters For Mortgage Loan

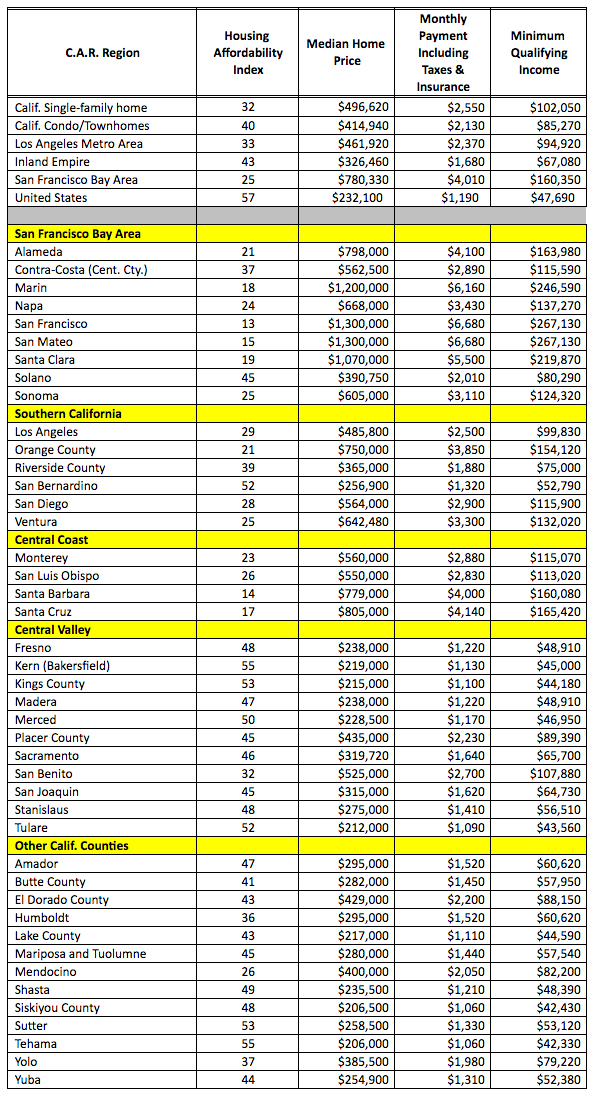

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

How Much Mortgage Can I Qualify For

Home Loan For Resale Flats Eligibility Documents Tax Benefits

Mortgage Income Calculator Nerdwallet

You Need A Budget Ynab This Is By No Means An Exhaustive List But It S A Great Place To Start Follow The Link Below For A List Of 40 Variable Expenses

How Much Home Can You Afford Www Hudhomenetwork Com

Can Expats Get A Mortgage For Buying Property In Ksa Saudi Scoop

How Much Should I Have Saved In My 401k By Age

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

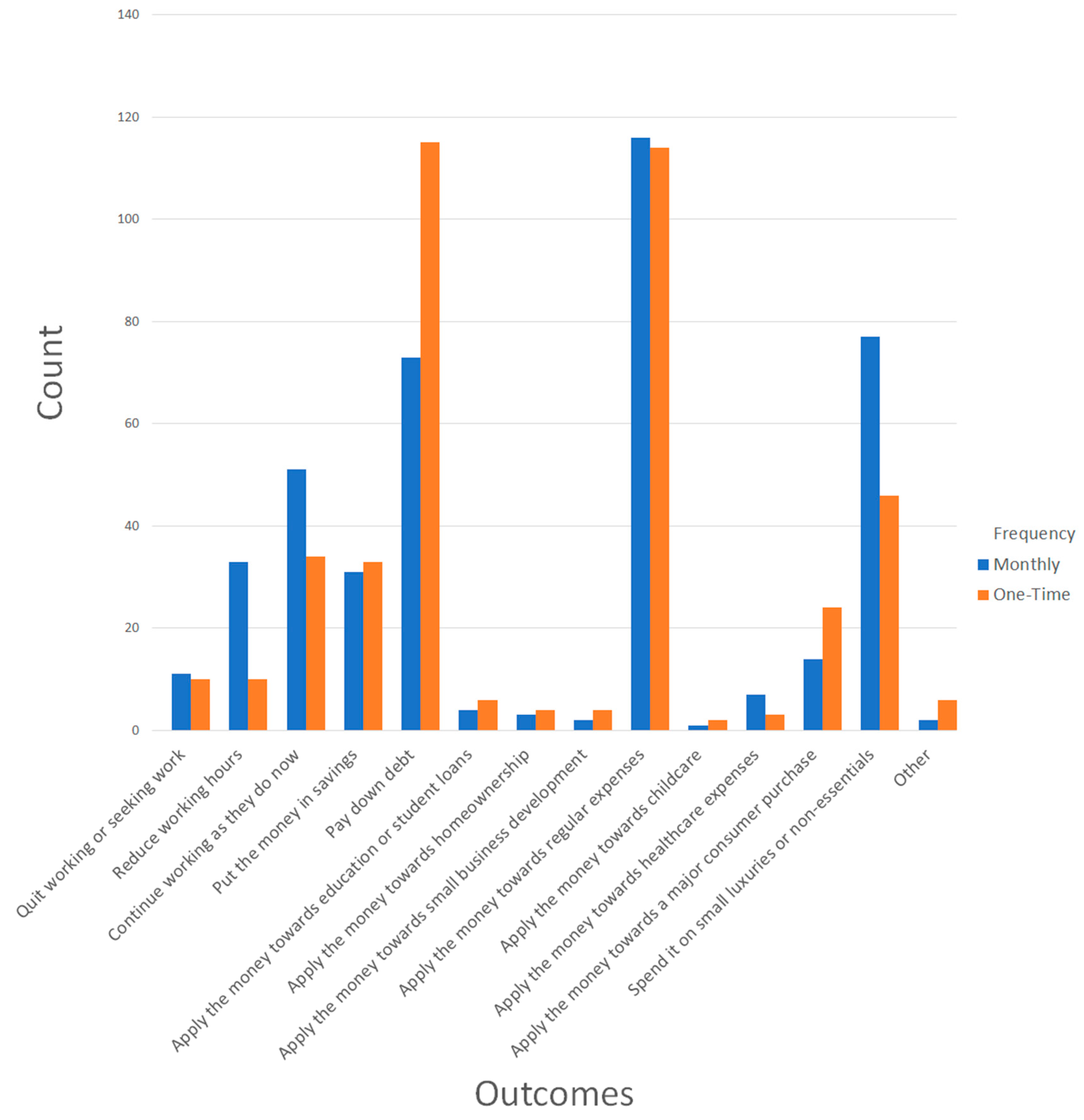

Social Sciences Free Full Text Does Frequency Or Amount Matter An Exploratory Analysis The Perceptions Of Four Universal Basic Income Proposals

What Percentage Of Your Income To Spend On A Mortgage

What Percentage Of Your Income To Spend On A Mortgage

Mortgage Fraud Complete Guide On Mortgage Fraud

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What Income Is Considered When Buying A Mortgage

Economics Student Proposes A Way To Tax The Rich His Wealthly Professor Gets Mad R Selfawarewolves